UK house prices in Q2 2025: West Midlands approaches key threshold

At Carpenter Surveyors, we always keep a close eye on market trends so our clients stay informed about how the property landscape is shifting. New figures from Nationwide Building Society show that the average house price in the West Midlands has reached £248,576, putting it just shy of the significant £250,000 milestone.

This marks a 2.3% annual rise in the region, which includes areas such as the Black Country, Staffordshire and Shropshire. Notably, this means the West Midlands is outperforming its neighbours in the East Midlands, where average house prices are around £236,000.

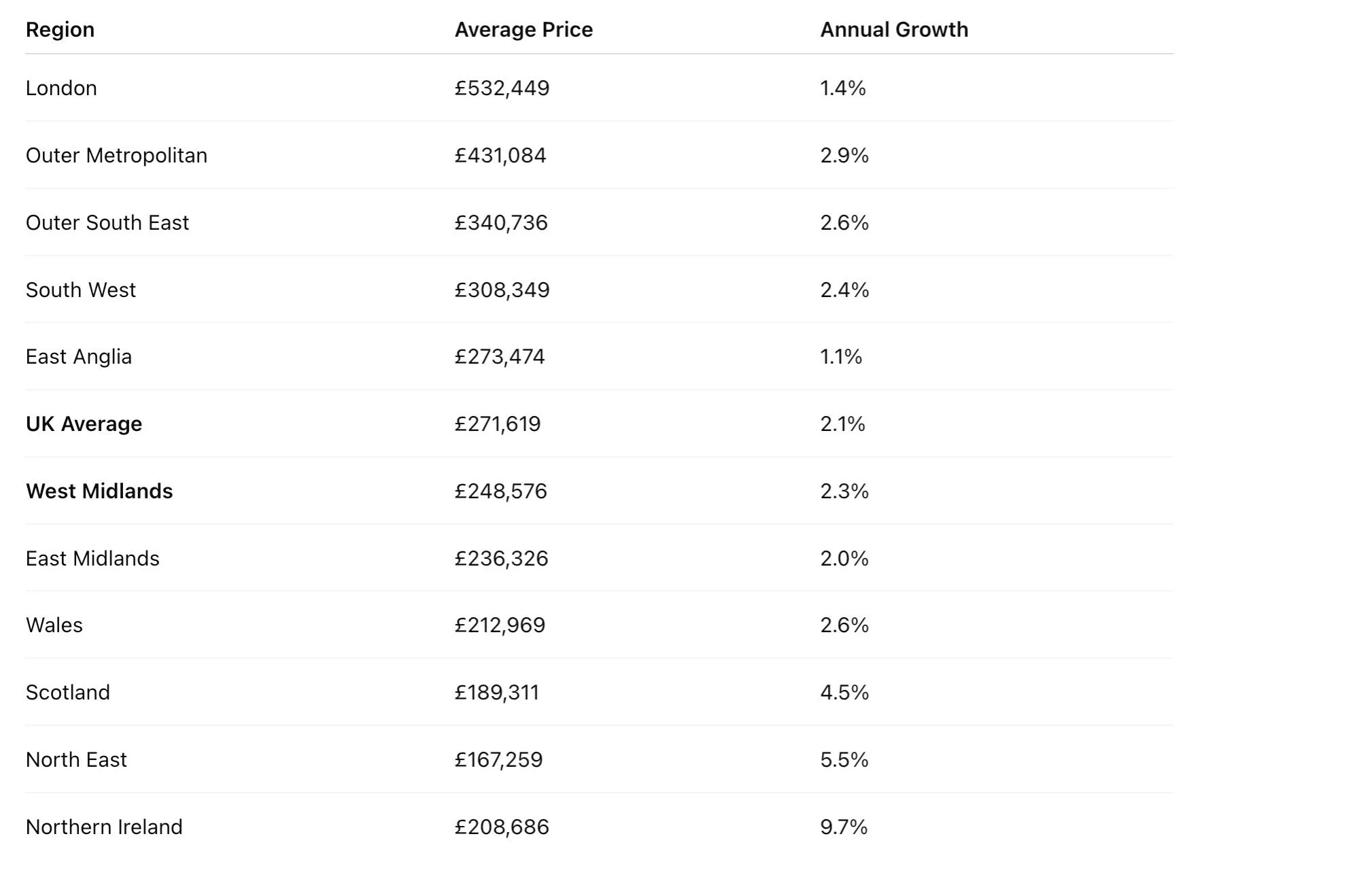

Regional Rankings – Where the West Midlands Stands

While the UK average house price in June stood at £271,619, the West Midlands still lags behind by over £20,000. However, the region fares better than many others, including Wales (£212,969), Scotland (£189,311) and the North West (£222,643).

Here are the latest regional figures for the second quarter of 2025:

Slowing Growth, Yet Positive Signs

While prices have risen over the past 12 months, there are some indications that the market is cooling slightly. Nationwide reports a 0.8% month-on-month dip in prices in June and a slowdown in annual growth across much of the UK.

Robert Gardner, Chief Economist at Nationwide, noted that the softening in growth may be linked to weaker demand following the end of the stamp duty discount earlier this year. However, he remains cautiously optimistic, suggesting that activity may pick up over the summer as broader economic conditions remain supportive for buyers.

House Prices by Property Type

Nationwide’s figures also reveal how different property types have performed:

Terraced homes saw the highest price growth at 3.6% year-on-year

Semi-detached properties increased by 3.3%

Detached homes rose by 3.2%

Flats, however, saw only a 0.3% increase, down from 2.3% in the previous quarter

Expert Views on the Market

Tom Bill from Knight Frank highlighted the "legacy of the March stamp duty cliff edge" as a key factor influencing the current market. Higher stock levels and softer demand are keeping a lid on price growth.

Jason Tebb, President of OnTheMarket, pointed to steady activity despite the earlier rush to beat the stamp duty deadline. He noted that increased stock is helping to keep house prices in check, particularly in areas where supply now outpaces demand.

Sarah Coles of Hargreaves Lansdown offered a balanced view. On the one hand, mortgage approvals are picking up, interest rates are falling, and wages remain ahead of inflation. On the other, wage growth is slowing, unemployment is creeping up, and mortgage deals are not becoming significantly more affordable just yet.

What This Means for Buyers and Sellers

For buyers, the current climate presents a chance to negotiate on price and take advantage of increased choice in the market. For sellers, it is important to price realistically. With demand softening and competition rising, a well-priced property is more likely to attract serious interest.

At Carpenter Surveyors, we are here to guide you through every step of your property journey – whether you're looking to buy, sell or simply understand your home's current value.

If you’re considering a survey or need a professional valuation, get in touch for a quote from our experienced team today.